What is Insider Trading?

Insider Trading involves company insiders, such as key employees, promoters, or directors, buying or selling the company’s stocks or securities and reporting these transactions to the exchange. This practice is legal when properly disclosed, adhering to the SEC's Prohibition of Insider Trading regulations. Trendlyne’s ‘Insider Trading & SAST’ feature tracks these disclosed transactions.

Key terms related to insider trades are:

- Exercise or Conversion of Derivative Security: When an insider converts options or other derivative securities into stock, it's termed 'Exercise' or 'Conversion.'

- Gift of Securities: The transfer of stock without payment between insiders or charities is labeled as a 'Gift.'

- Grant, Award, or Other Acquisition of Securities: Receiving stocks through grants or awards from the company is termed an 'Acquisition.'

- Other Type of Transaction: Any insider transactions not classified under common categories are labeled 'Other.'

- Payment of Exercise Price or Tax Liability: Insiders covering exercise prices or taxes by surrendering part of their stock engage in 'Payment' transactions.

- Purchase of Securities: Insiders buying stocks on the open market or privately is known as a 'Purchase.'

- Sale of Securities: When insiders sell their stocks on the market or privately, it is considered a 'Sale.'

- Sale or Transfer of Securities Back to the Company: Insiders returning stock to the company, often in buyback scenarios, is termed a 'Sale or Transfer.'

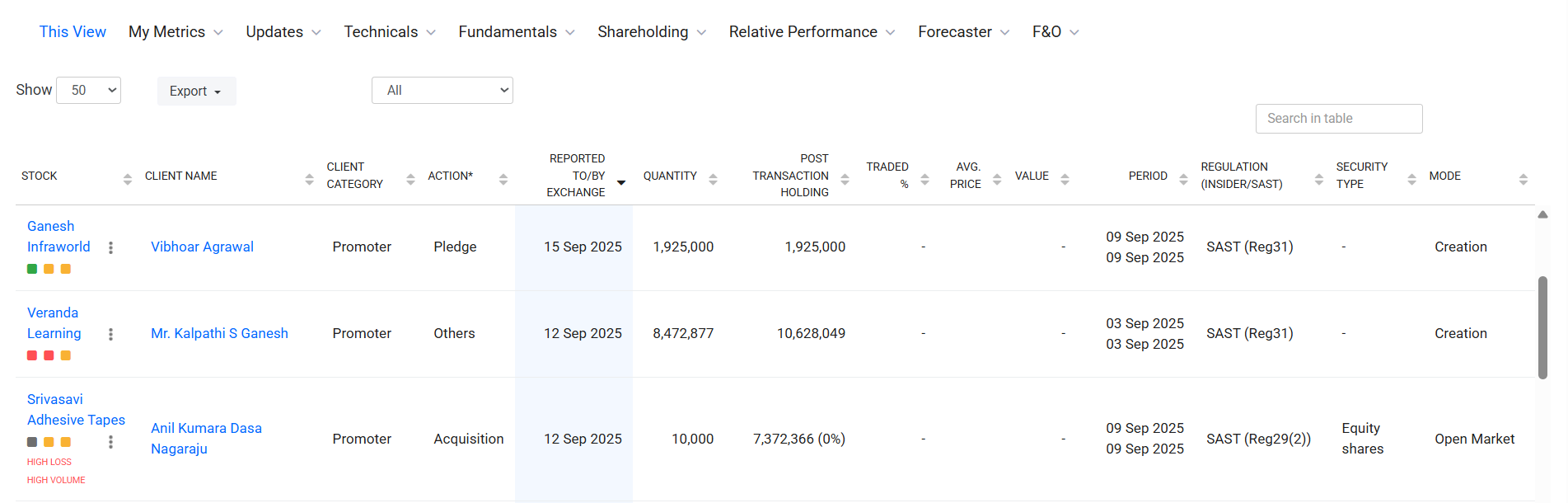

What is SAST Trading?

SAST trades are done by non-insiders, such as promoters, promoter groups, institutional investors, or other large public shareholders. These are not routine insider trades but disclosures made when someone acquires or sells a substantial stake in a company.

Key terms related to insider trades are:

Acquisition: Buying additional shares that push the investor’s stake above a reporting threshold.

Sale: Selling shares that reduce the investor’s stake and cross below a reporting threshold.

Creeping Acquisition: Gradually increasing shareholding within the permissible annual limit without triggering an open offer.

Open Offer Trigger: When a shareholder’s stake crosses the prescribed threshold (typically 25%), requiring them to make an open offer to other shareholders.

Change in Voting Rights: Any change in voting power due to acquisition or disposal of shares.

What is a ‘Bulk Block Deal’?

A bulk deal is generally defined as a deal where the total shares traded are greater than 0.5% of the share capital of the company. Block deal refers to a transaction of 5 lakh shares or Rs 5 crore between two parties.

‘Bulk Block Deals’ show large trades carried out by promoters, banks, financial institutions, foreign institutional investors, and others. Block deals take place during morning hours while Bulk deals can take place at any time during the day.